COVID-19 Outlook: Omicron Adds More Uncertainty to Winter COVID-19 Resurgence

Increases in COVID-19 case incidence continue this week in many counties, just in advance of the Christmas and New Year’s holidays. What’s more, the emergence of the omicron variant in some regions of the country adds a level of uncertainty as families prepare to travel and gather in the next two weeks. Following an analysis of our latest COVID-Lab forecasting models, our blog post this week highlights again the variable nature of regional experiences and examines the trajectories for the coming holiday weeks in the context of emerging data about omicron.

Let’s start with the updated national data:

- National average PCR test positivity declined to 9.9% this week, down from 10.4% last week. While test positivity is rising in just 40% of the 812 counties we’re monitoring this week, compared to 75% last week, the majority of counties continue to have test positivity over 9%.

- The average reproduction number (a measure of transmission that estimates how many additional individuals, on average, will be infected by every positive case) declined to 1.17 from 1.31 last week. Although this rate is decreasing, 85% of counties still had a median reproduction number of greater than 1 over the last two weeks, indicating rising case incidence.

- Average case incidence rose to 282 weekly cases per 100,000 residents, up from 250 weekly cases per 100,000 residents last week. Nearly 60% of counties have a weekly case incidence in excess of 200 weekly cases per 100,000 residents, and approximately 30% are in excess of 400 weekly cases per 100,000 residents (up from 23% last week).

- National adult hospital census reached 60,000 patients this week. While this is high, it is still far less than last year’s peak of 135,000 hospitalizations around New Year’s and less than the summer 2021 peak, which neared 100,000 patients. Pediatric hospital census plateaued this week at 800 children and pediatric admissions have stalled at about 200 per day.

- States with the highest adult hospital census, defined as exceeding 40 hospitalized patients per 100,000 residents include (from highest to lowest rates): Michigan, Indiana, Ohio, Arizona, Pennsylvania, New Mexico, Nebraska, West Virginia, Delaware, North Dakota and New Hampshire.

Here are the regional updates:

- PCR test positivity rates are declining across a greater proportion of the Midwest, and our forecasts show this region may be nearing peak case incidence. Still, impacts have been significant, as Michigan eclipsed previous peaks in hospitalizations and deaths and Missouri has reached a hospital census of nearly 80% of its summer peak. ICU occupancy rates throughout the region average 30-40%, with even higher rates in the Upper Midwest.

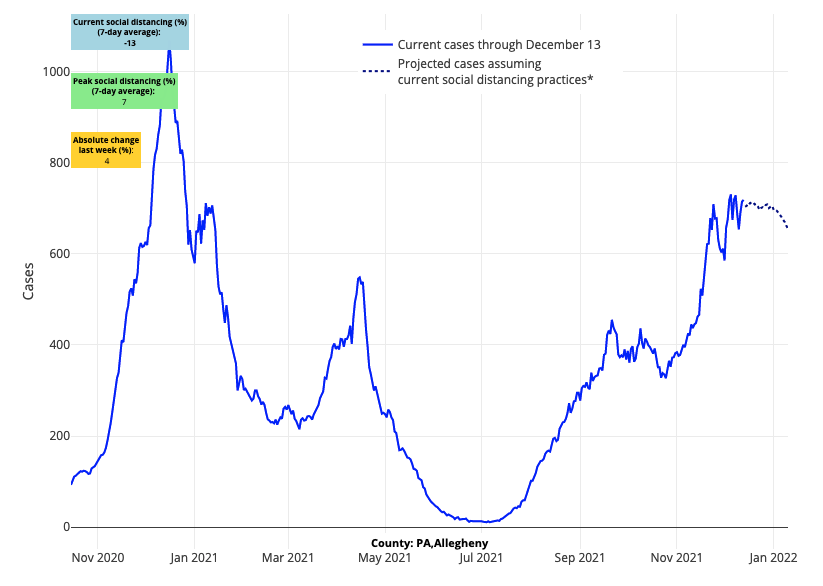

- According to our projections, the I-80 corridor from Illinois through central Pennsylvania is nearing peaks in case incidence, from west to east. This may bring relief to hospitals that have seen hospital census numbers exceed 40 hospitalized patients per 100,000 residents.

Above are the projections for Allegheny County in Pennsylvania.

- The geographic regions with the most quickly accelerating case incidence and hospitalizations are the Northeast and Mid-Atlantic, although northern New England is reaching peak incidence. While Essex County (Boston), Mass., has surpassed a case incidence of 500 weekly cases per 100,000 residents, there is some evidence that Massachusetts may soon reach its peak, suggesting improvements may start in the north and spread to the south in the coming weeks.

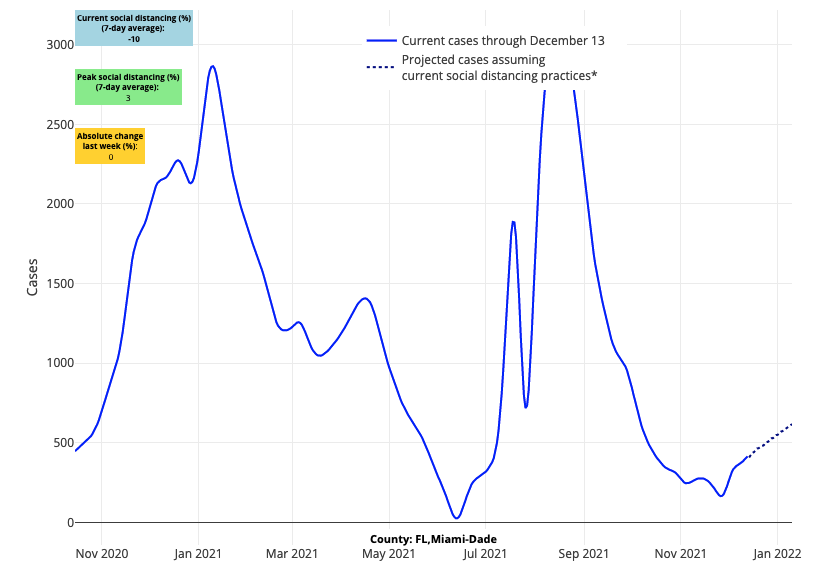

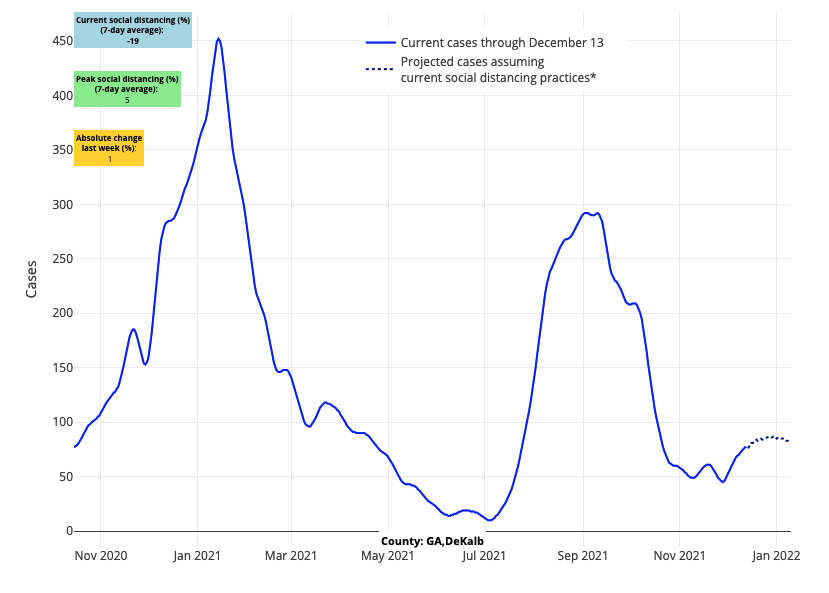

- Rising reproduction numbers and case incidence around Atlanta, Nashville, and in communities along the coastlines of South Carolina and Georgia will bear close observation throughout the holidays, as our forecasts show increasing risk for this region. Despite stable rates of hospitalizations in Florida and Louisiana, we are seeing some signals that this rate my rise in the coming weeks, particularly in Miami.

Above are the projections for Miami-Dade County in Florida.

- We are now detecting rising risk in Texas’ metropolitan areas, where our forecasts for Dallas, Houston and San Antonio show increasing case incidence over the next four weeks. Hospitalizations have just begun to increase in the region.

- Since Thanksgiving, case incidence and emergency department visits have risen in western metropolitan areas from California up to Seattle. While case incidence and hospitalization rates remain lower than other regions of the country, we are now projecting increases in case incidence over the next four weeks in San Diego, San Francisco, Portland and Seattle.

Post-Thanksgiving impacts continue to emerge as Christmas approaches

This week’s models reveal the continued complexity of this pandemic, with some regions improving but others worsening before the coming holidays. Still, our projections show that there are an increasing number of counties moving toward peak transmission.

The Midwest has broadly improved over the last two weeks, even as hospitalizations remain high. Our models forecast declines in case incidence over much of this region before the end of the year. Increasing travel and gatherings around Christmas and New Year’s may introduce new accelerated transmission risk that might threaten this declining trajectory, but as we’ve witnessed in Colorado recently, when a region moves past peak, it can be resilient to a subsequent resurgence. This is welcome news for states like Michigan that have neared a hospital census of 60 per 100,000 residents and eclipsed 75 deaths per day.

Recovery is also likely to expand soon to other states experiencing significant resurgence right now, including Illinois, Indiana, Ohio and Pennsylvania. This region of the I-80 corridor has arguably had the most difficult experience during this seasonal resurgence, but our projections show declining case incidence over the next four weeks across Indiana, Ohio and into western Pennsylvania. Even as these areas near peak case incidence, we should not understate the potential for sustained high hospital census in excess of 40 patients per 100,000 residents, particularly in localities with lower vaccination rates.

The areas of greatest concern for the coming weeks are those that continue to see accelerating case incidence and test positivity in advance of the holidays—New England down the I-95 corridor to the Mid-Atlantic. In this part of the country, which has seen rapid growth in hospitalizations, our models project continued increases in case incidence through Christmas. Zooming in, while risk has begun to abate in more northern and rural areas of this region, where reproduction numbers have declined toward or below 1, the large urban metropolitan areas have not followed suit and are demonstrating some of the highest reproduction numbers in the country. We are also increasingly attentive now to the Southeast, where case incidence has begun to grow quickly again; hospitalization rates have not yet reached those of northern and western states, but increased hospital admissions may be on the horizon for this region.

Above are the projections for DeKalb County in Georgia.

How will omicron’s arrival in the U.S. impact this winter resurgence?

The cautious optimism noted above for some regions may be undermined by the increasing presence of omicron in the U.S. Omicron has become the dominant strain of SARS-CoV-2 in Europe and South Africa, leading to significant discussion of what this will mean for our country’s experience this winter.

The fact is it is still too early to estimate how omicron may alter the epidemiologic curve of a specific region. Will omicron accelerate case numbers in areas with already rising case incidence? Will it reverse improvements in regions that have begun to recover from recent resurgent peaks? The answers to these questions are still not available, but this week’s report of a significant outbreak of omicron among mostly vaccinated students at Cornell University (where 97% of the campus is vaccinated) underscores the potential for omicron to drive transmission within a highly vaccinated population existing in a community already experiencing increased case incidence from the delta variant.

Fortunately, the testing platforms that inform the data we use in our models detect the omicron variant, so our projections will reflect increasing incidence driven by this variant should it be present in the counties we monitor. We will watch closely in the coming weeks if other localities have a similar experience to that of Cornell University as omicron is introduced. We suspect that omicron is already impacting areas experiencing increasing case incidence, such as communities in the Northeast and perhaps in areas out West; our forecasts will, therefore, capture the experience of these regions as omicron grows in proportion to the delta variant.

In areas where we are projecting improvements, such as the Midwest, our forecasts need to come with the asterisk as we don’t yet know if, when, or how omicron can re-aggravate a region that is beginning to improve from a recent peak. We will be watching our models for unexpected changes in trends in case incidence and hospitalizations in the coming weeks. Many predictions are being offered, but ultimately local-area epidemiologic data on PCR positivity and case incidence (like we use in our models) will tell us the truth—we must remain grounded in these data as they become available.

We would also note, with some optimism, that early reports from other areas suggest that omicron is less likely to cause severe disease. The Cornell University outbreak, from which infections were universally mild, may equally be interpreted as demonstrating the benefit of the vaccine for reducing severe disease, as well as demonstrating that this variant may also be less severe. However, because the milder spectrum of disease at Cornell cannot be generalized to older or more vulnerable Americans, it will be important for us to juxtapose case incidence and test positivity data with hospitalization data. If omicron is less likely to cause severe disease but becomes the driver of case incidence in the coming months across all age groups, we might expect to see high case incidence without an accompanying high hospitalization rate. For this reason, we are closely comparing case incidence now with hospitalization rates per population within counties. In the coming weeks, our data and blog posts will be more informed by this metric as the burden on hospitals will become far more important in assessing the gravity of this stage of the pandemic.

Regardless of which variant is fueling a given stage of this pandemic, no variant (even the most transmissible) can spread in a vacuum. This virus requires an engine, whose components are defined by behaviors of exposed and unexposed individuals and environmental patterns that serve to establish scenarios (i.e., close proximity of larger groups indoors) that allow the virus to efficiently spread. So, while we are concerned about omicron and what it might bring, we are hopeful that after holiday gatherings subside, increased booster dosing will allow us to welcome a period of declining incidence for many areas, much like last year.